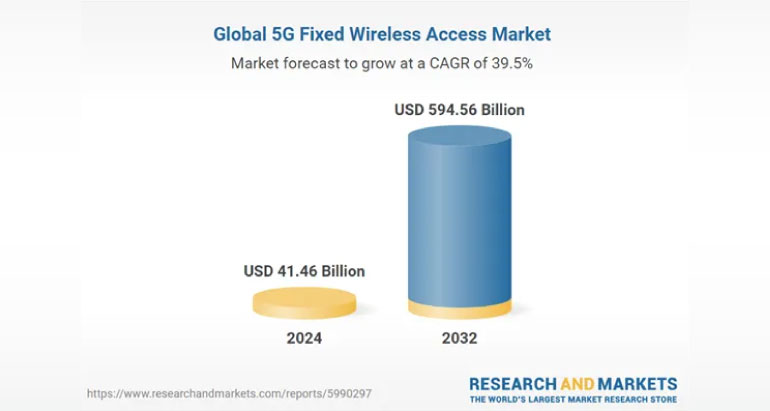

The global 5G fixed wireless access market size reached approximately USD 29.71 billion in 2023. Aided by the rapid deployment and adoption of 5G networks worldwide, the market is projected to grow at a CAGR of 39.5% between 2024 and 2032, reaching a value of around USD 594.56 billion by 2032.

The global 5G Fixed wireless access market is witnessing a significant surge, driven by technological advancements, increasing demand for high-speed internet, and strategic initiatives by key players. 5G FWA is emerging as a vital component in bridging the digital divide, offering robust, high-speed internet connectivity to areas with limited access to traditional broadband infrastructure.

One of the most critical 5G fixed wireless access market trends is the rapid deployment and adoption of 5G networks worldwide. As telecom operators roll out 5G infrastructure, FWA is becoming a practical solution for delivering high-speed internet to residential and business customers. 5G FWA leverages the high bandwidth and low latency characteristics of 5G technology to provide internet services that rival traditional fibre and cable connections. This capability is particularly beneficial in rural and underserved urban areas where laying down physical broadband infrastructure is cost-prohibitive. The accelerated pace of 5G network expansion is thus directly fuelling the market growth.

The increasing demand for high-speed and reliable internet connectivity is another significant factor propelling the global 5G fixed wireless access market growth. As more activities move online, from remote work and education to streaming and gaming, the need for robust internet connectivity has never been higher. 5G FWA offers a viable alternative to conventional broadband, providing ultra-fast speeds and stable connections. This is attracting a growing number of consumers and businesses looking for efficient internet solutions, particularly in regions with inadequate wired broadband infrastructure. The ability to quickly deploy 5G FWA without the extensive groundwork required for fibre optics makes it an attractive option for meeting the burgeoning demand for high-speed internet.

Innovative business models and strategic partnerships are also influencing the 5G fixed wireless access market value. Telecom operators are collaborating with technology providers, equipment manufacturers, and government bodies to accelerate the deployment and adoption of 5G FWA. These collaborations are crucial in developing comprehensive solutions that address the technical and logistical challenges of rolling out 5G FWA on a large scale. Additionally, operators are exploring new business models, such as subscription-based services, bundled offers, and flexible pricing plans, to attract a diverse customer base. These strategies are helping to drive the market growth by making 5G FWA more accessible and affordable to a broader audience.

The role of government initiatives and regulatory support cannot be understated in the growth of the 5G fixed wireless access market. Many governments worldwide are recognising the potential of 5G FWA in achieving their digital inclusion goals. Policies aimed at promoting the adoption of 5G technology, coupled with financial incentives and subsidies, are encouraging telecom operators to invest in FWA infrastructure. Regulatory frameworks that facilitate the allocation of spectrum and streamline the deployment process are also playing a crucial role in accelerating the market growth. The support from public sector entities is pivotal in overcoming the initial deployment challenges and fostering a conducive environment for the widespread adoption of 5G FWA.

Technological advancements in network equipment and consumer devices are enhancing the 5G fixed wireless access market value. Improvements in antenna technology, signal processing, and network management are enabling more efficient and reliable FWA services. On the consumer side, the availability of 5G-compatible routers and customer premises equipment (CPE) is making it easier for users to adopt 5G FWA. These advancements are not only improving the performance and reliability of 5G FWA but also reducing the cost of deployment and operation, thereby making it a more attractive option for both providers and consumers.

The COVID-19 pandemic has further underscored the importance of reliable internet connectivity, boosting the global 5G fixed wireless access market expansion. With a significant increase in remote work, online education, and digital entertainment during the pandemic, the limitations of existing broadband infrastructure have become more apparent. 5G FWA has emerged as a critical solution to address these limitations, offering quick and efficient deployment to meet the sudden surge in demand for high-speed internet. The pandemic has thus accelerated the adoption of 5G FWA, highlighting its potential as a future-proof connectivity solution.

In terms of regional dynamics, the 5G FWA market is experiencing varied growth patterns across different geographies. North America and Europe are leading the market, driven by early adoption of 5G technology, substantial investments by telecom operators, and strong regulatory support. The Asia Pacific is emerging as a significant growth region, with countries like China, Japan, and South Korea making rapid strides in 5G deployment. The region's large population and increasing internet penetration are creating substantial opportunities for 5G FWA. Meanwhile, developing regions in Africa and Latin America are also beginning to explore the potential of 5G FWA to overcome connectivity challenges, albeit at a slower pace due to economic and infrastructural constraints.

Competitive Landscape

The report looks into the market shares, plant turnarounds, capacities, investments, and mergers and acquisitions, among other major developments, of the leading companies operating in the global 5G fixed wireless access market. Some of the major players explored in the report are as follows:

- Samsung Electronics Co. Ltd.

- Huawei Technologies Co. Ltd.

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- Inseego Corp.

- Qualcomm Technologies, Inc.

- Verizon Communications Inc.

- Siklu Communications, Ltd.

- CommScope, Inc.

- Cohere Technologies Inc.

For more information about this report visit https://www.researchandmarkets.com/r/lxq0mu